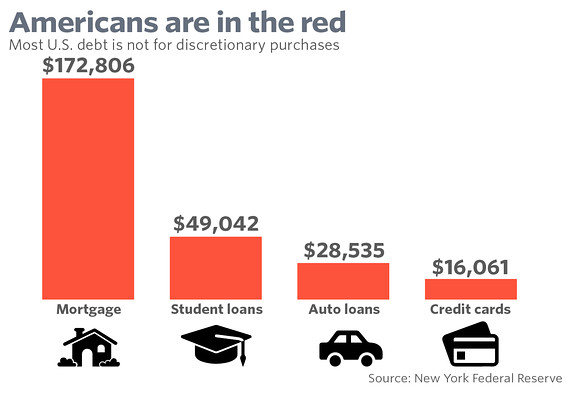

The average American household has over $137,063 in debt according to the Federal Reserve. Considering the average household income was $59,093 in 2016, this is an astonishing disparity and clearly indicates Americans struggle with a debt problem on a large scale. Paying down debt, staying out of debt, and saving money can all be daunting tasks, but these key suggestions can help you move in the right direction.

Create a Budget

To begin, every person who wants to maintain a health financial situation must be operating with a budget. Businesses use a budget for a reason; it creates a layer of accountability and can help them carefully control their spending habits. Every individual should be treating their personal finances like a business, with careful consideration made for each expenditure.

As a general rule of thumb, an individual should be spending no more than 30% of their after-tax income on housing (including utilities). If your after-tax monthly income is $3000, rent should not exceed $900. After that, food and necessities such as healthcare should not exceed 30%. Another 20% of your income should be dedicated to paying down debt, or building savings, with a remaining 20% for discretionary spending such as vacations, going to the movies, hobbies, etc.

Cut Unnecessary Bills

Oftentimes when creating a budget, a person can forget to look at existing expenses they deem essential. For example, just because a cell phone bill is a necessity in this day and age, doesn’t mean it needs to be the amount you’re currently paying. Is there a cheaper alternative? Can another provider meet the same requirements? Readers on our blog have found success in negotiating their current plan with their provider or seizing the opportunity to ask for promotional pricing if they are a loyal customer. Another unnecessary bill could come in the form of utilities. Heating your home during the day while nobody is home? Maintaining a pool during the summer? All of these are expenses that can be easily whittled down based on simple choices. Lastly, cable is another expense that can easily be axed. With the overwhelming prevalence of affordable online streaming services such as Hulu, Netflix, and HBO GO, do you really need to be paying $150 a month for a cable subscription? Is this a bill that you can whittle down to $30 a month by choosing to use the aforementioned alternatives?

Develop a Passive Source of Income

The sharing economy has made this increasingly more possible. If you have a spare room in your home, you could turn to Airbnb to rent it out to wayward travelers. If you have an extra car, or are able to bike or walk to work, you can rent your vehicle on Turo when it is not in use. Remember that 20% that you should be dedicating to paying down debt or building savings? You might also want to consider investing that in peer-to-peer lending. Companies such as USA Express Loans are developing platforms for you to fund short-term payday loans in California. You can lend your money at an interest rate you feel is fair and will cover your risks. Investors in peer-to-peer lending tend to see 5 to 15% yearly return on investment (ROI). This is significantly more than the typical savings account.

Get a Part-Time Job

It doesn’t need to be forever, but working a part-time job is a great way to pay down debt or bank some extra savings. Readers on our blog have reported taking up part-time work to quickly pay down debt and absorb compounding interest, or to build up their savings and their emergency cushion.

Consolidate Your Debt

Oftentimes, interest rates on credit cards and personal loans can be exorbitant. Debt consolidation is a legitimate option to lower the effective interest rate on your total debt balance. Online lenders such as Prosper or Lending Club may be able to offer a large loan at an interest rate that is lower than those of your various credit card and signature loan debts. You can use the funds from this loan to pay off all of your scattered debt and bundle it into one more affordable and manageable monthly payment. This isn’t an option for everybody. Borrowers should be aware that “origination fees” and “processing fees” can tack on additional costs that aren’t necessarily factored into the APR.

Set Realistic Goals

One key tip to staying out of debt, paying down debt, and saving money is to set realistic benchmarks on a weekly, monthly, and a yearly basis for your financial plan. In addition to establishing a budget, a smart saver should know exactly where their debt balances (if any) will be at the end of a year, or where their savings balance should be. Having a specific number to strive towards can hold a person accountable for their financial situation and provide a much-needed feeling of success if those benchmarks are reached.

Remember to Seek Outside Help

Managing your financial situation can be a tough task. Readers should know it is always okay to reach out and ask for help. There are experts in the field of financial planning and budgeting who can set you on the right path and hold you accountable to your goals. It helps to remind yourself that financial freedom is a goal truly worth obtaining. A healthy financial picture can ease the stress of many other aspects of life.